The inflation puzzle

Guest article by Peter Frech, Fund Manager / Published in the

Quantex

-Anlegerbrief from June 2022

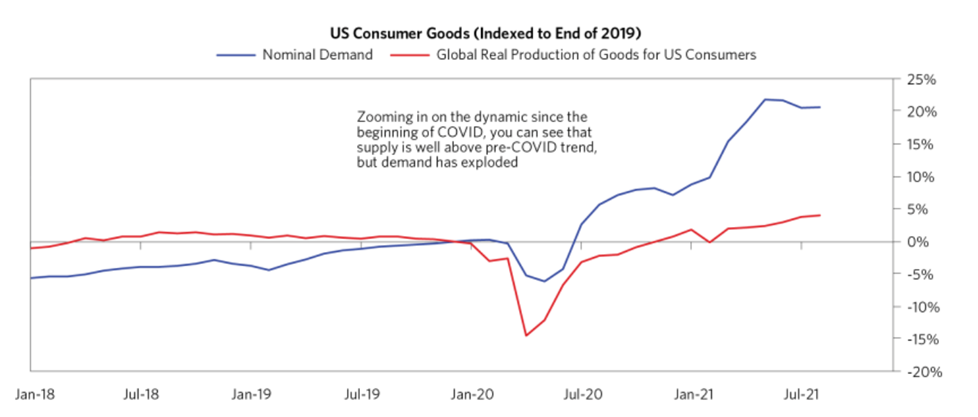

“Inflation is always and everywhere a monetary phenomenon,” was the well-known credo of the late economist Milton Friedman. However, it seems to have been very much forgotten today. Instead, the ongoing wave of inflation is being explained by supply bottlenecks and Putin’s war against Ukraine. Blaming inflation on foreign powers or even profit-hungry entrepreneurs is an old political trick. But it makes no logical sense: If particular goods, such as oil or chips, become more expensive because of boycotts and production bottlenecks, and people cannot do without them, the prices of these goods become relatively more expensive. But then consumers would have less money for other things. So prices in other areas would tend to fall. Only the relative price structure changes due to supply shortages, not the overall price level. Blaming supply chains doesn’t make sense in practice either. According to Bridgewater’s calculations, real output of goods for the U.S. consumer already exceeded pre-Corona levels by January 2021.

The trend in the production of consumer goods for the USA (red line) has long since risen above pre-Corona levels. In contrast, the increase in nominal demand due to the growth of the money supply is extreme. (Source: Bridgewater Associates)

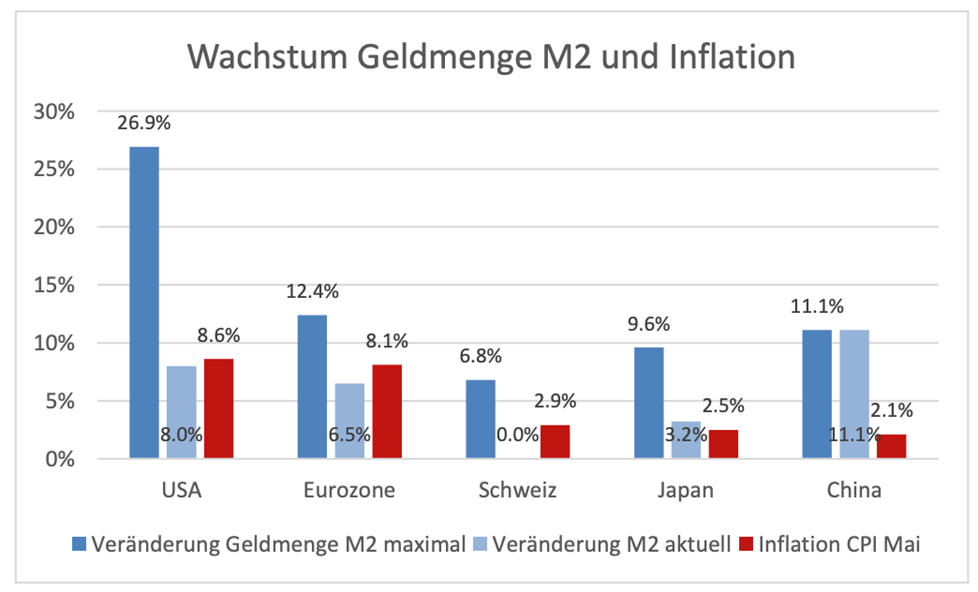

The practical proof that supply bottlenecks and war cannot be the cause of inflation is the comparatively very low inflation in countries such as Switzerland (2.9%), Japan (2.5%) or China (2.1%). All three, of course, were affected by Corona lockdowns. All three import large quantities of oil, metals and grain, commodities on which the Ukraine war is having a major impact. But inflation rates in these countries are hovering around 2-3%, while the U.S. and the Eurozone are currently at 8-9% (see chart below).

The bars in blue show the maximum growth rate of the M2 money supply over 12 months since the beginning of the Corona crisis, as well as the current growth rate. The red bars show the current inflation rate over 12 months. (Source: Bloomberg)

The fairy tale of supply bottlenecks

One does not need to perform complex statistical analyses to be able to recognize from the chart above that there is a direct correlation between the growth of the M2 money supply since the Corona crisis and today’s inflation level. And this relationship between money supply growth and inflation makes a lot more sense in contrast to the supply shortage fairy tale. Ultimately, money is merely just another relative good in the economic cycle: If the number of dollars and euros in circulation grows signigicantly without a corresponding increase in the production of goods, the prices of all goods in dollars and euros will rise. Quantitative Monetary Theory has its historical origins in the 16th century. It is well founded, both theoretically and practically, although of course one can argue endlessly about its particular nuances and creating forecasts based on it can be difficult. But what makes the money supply grow? Generally speaking, it can be due to fiscal deficits as well as credit expansion in the banking system. What is the best money supply measure to use? We chose to use M2 (central bank money, cash, and current and savings accounts at banks), because it is arguably the most relevant for inflation. And what about the velocity of money in circulation? It is a somewhat mysterious measure, but it usually does not change much in the short term. However, these details are not so important for the practice of investing. What is crucial to understand is that it is not the supply shortages that cause all prices to rise, but the newly created money in circulation.

Unsurprisingly, staunch supporters of Quantitative Monetary Theory, such as Steve Hanke, were also the only economists who correctly predicted the current wave of inflation. The U.S. professor and former presidential adviser in the 1980s predicted inflation of 6% to 9% in a July 2021 op-ed in the “Wall Street Journal.” Hanke pointed out that inflation usually follows strong money supply growth with a lag of 12-24 months. In a recent interview with Jefferies, the economist highlights that the U.S. M2 money supply has grown by a whopping 41% since February 2020. By no means has all of this been reflected in inflation data or offset by productivity gains. He does not see inflation easing from the current level of 6-9% until the end of 2023.

The (in)competence of central banks

Still, the biggest inflation puzzle of our day remains: why did so few economists, central bankers and institutional investors see the ongoing inflation wave coming? According to a survey by Bespoke Investment, economists’ consensus estimate for U.S. CPI was too low in May for the 22nd time in the last 24 months. And let’s not even mention the ridiculously low inflation forecasts of the ECB and the Fed for 2021 and 2022. Interestingly though, the Fed alone employs over 700 economists whose marginal utility appears to be close to zero. Basically, there are three possible explanations for this:

- Central bankers are incompetent: decades of disinflation have caused even basic knowledge of Quantitiative Theory and of the causes of inflation to disappear and have encouraged the use of incorrect models.

- Central bankers are ideologically blinded: They understand Quantitative Theory perfectly well, but do not want to admit it for political reasons. The ratio of self-declared Democrats to Republicans at the Fed is 48 to 1, according to Steve Hanke, so they don’t want to stab the Biden administration in the back and are hoping for a spontaneous slowdown in inflation. Similarly, in the Eurozone no one at the ECB wants interest rate spreads for over-indebted southern European countries to go through the roof.

- The central bankers are cynical: They are competent and know that their policy direction is inflationary, but they deliberately accept this in order to enable the deleveraging of government budgets via inflation, to insidiously expropriate savers and pensioners, or simply to secure their well-paid jobs as public servants.

The true cause is probably a mix of all three explanations. But what really seems to be lacking is the first point, competence, at the moment. How will you fight inflation if you don’t understand its causes? Currently, governments in Germany, Italy and the United Kingdom, for example, can think of no better way to “fight inflation” than to distribute cash directly to the population so that people can afford the higher energy prices. This windfall is financed not by higher taxes but by the central banks’ printing presses. Of course, this does not bring down money supply and inflation, and the spiral continues.

Lessons learned from the last inflationary period

In the 1970s, the learning curve after the first inflation shock was relatively steep: Countries such as Germany, Switzerland and Japan did not allow the money supply to rise sharply thereafter and did not experience the second wave of inflation in 1979/80. After the second inflation shock, money supply growth was then also combated in the U.S. and elsewhere with massively higher interest rates and a supply-side policy was pursued. The result was decades of disinflation. We are still a long way from that today. It is of grave concern that today’s decision-makers will have to relearn the lessons of the past the hard way. Unfortunately for long-suffering investors and consumers, this means that inflation cannot fall sustainably until it first remains “too high” for quite some time.

Use our inflation calculator to find out how much your savings are affected by inflation and learn which investments offer protection against inflation.

Image source Cover image: wutzkoh – Envato Elements