A FINANCIAL SYSTEM AT BREAKING POINT

The next financial crisis is only a matter of time

Unprecedented public debt, rampant money supply expansion, an unimaginable amount of derivatives and enormous financial imbalances make our current financial system extremely unstable.

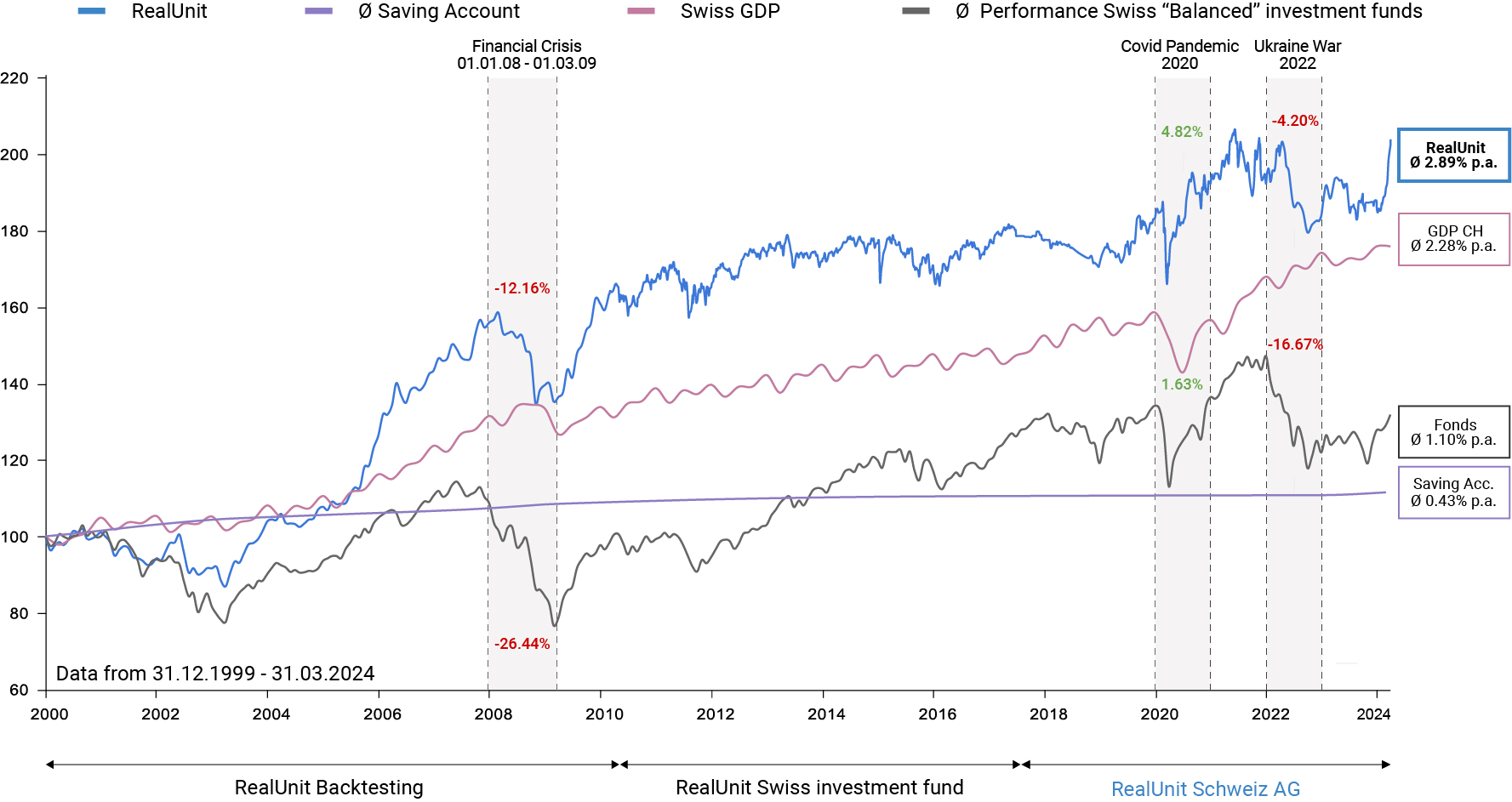

Politicians and central banks worldwide are running out of realistic and effective solutions and never before have states been so heavily indebted during peacetime. Debt creation at the expense of the next generation and rising inflation are the consequences of these actions. The unprecedented creation of money out of thin air and the politically motivated manipulation of interest rates by central banks have a direct impact on the value of our money. “By failing to prepare, you are preparing to fail”, as the saying goes and so it’s clear that now is the time to consider a crisis-resistant investment approach for your savings before the next financial crisis hits. While it might be impossible to tell precisely when it will happen, it is safe to assume that it will.