THE PROBLEM

Today's system is inherently unstable

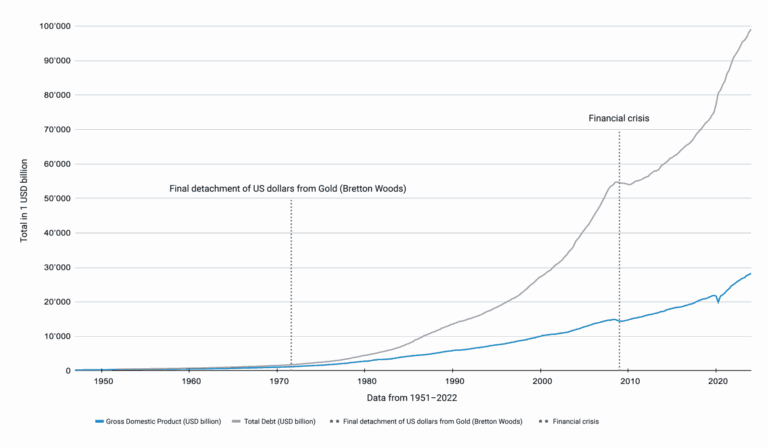

Unprecedented public debt levels, rampant money supply expansion and the enormous financial imbalances render our current financial system extremely unstable.

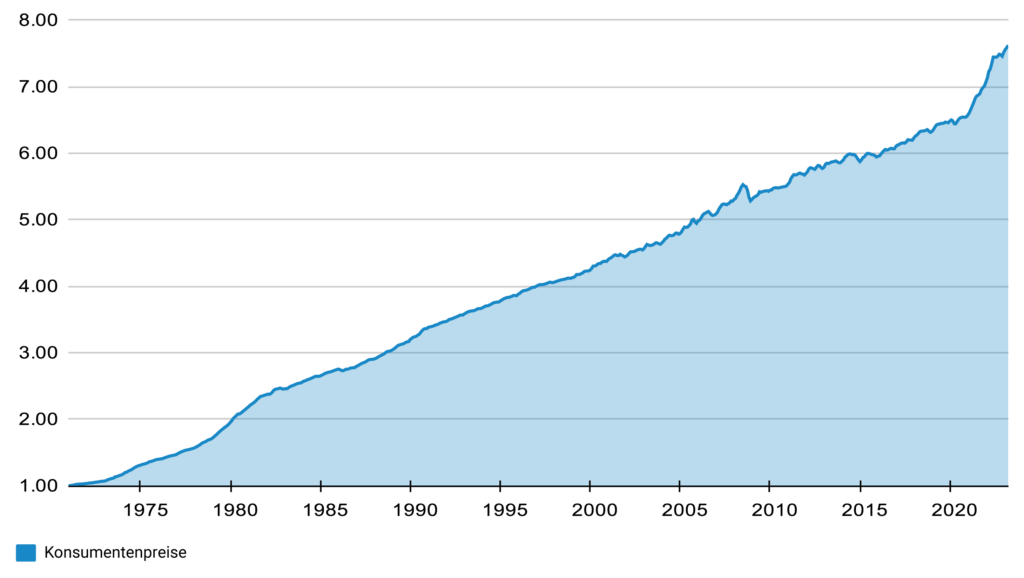

As politicians and central banks worldwide are running out of realistic and effective solutions, we are left to deal with rising inflationary pressures and continuous debt creation at the expense of the next generation. The unprecedented creation of money out of thin air and the politically motivated interest rate manipulations by central banks have a direct impact on the value of our money.

Since the end of the gold standard in the U.S. in 1971, all links between money and any real asset were severed, allowing for excessive debt accumulation to run rampant and leading to inflation.