By Karl Reichmuth, Founder RealUnit Schweiz AG

A marketing consultant recently described the RealUnit as an investment vehicle geared towards “asset protection”. However, since its inception, we have always emphasized different aspects of the RealUnit and we’ve always focused on our two original goals: value preservation and crisis resistance. Which is the most accurate assessment and why is it important to understand the distinction?

The consultant’s view is not wrong per se. The Western world is not only suffering from unprecedented levels of over-indebtedness, but it is also going through a period of social upheaval, unrest and heightened tensions. The dynamics, the challenges and the risks we face today are all eerily reminiscent of those that fueled the Reformation of the 16th century or the French Revolution in the 18th century. There is no doubt that there were different reasons, unique circumstances and specific triggers behind each of these historical cases, however, it is also undeniable that unsustainable, reckless and insupportable debt levels played a very important role in the downfall of both the Holy Roman Empire and the French monarchy. In this context, the record – breaking national debt of the US is clearly not a good omen.

The turbulent times we’re experiencing will also have an impact on the monetary system, which has so far revolved around and relied upon the US (thanks to the USD’s global reserve status). This unipolar dominance is beginning to waver in favor of the East, especially China. In these unstable and uncertain times, the idea of “asset protection” might sound attractive, but it is beyond the scope and the reach of private money issuers – people understand this “protection” promise in terms of nominal value and in relation to fiat money, which renders the pledge basically meaningless.

In stark contrast, every RealUnit investor is a shareholder in an investment company that owns real assets, such as physical gold. These assets can also fluctuate, but in our opinion they are more likely to retain their purchasing power in the long term than nominal investments such as government bonds. Our aim is to ensure that RealUnit shareholders will preserve the value of their investments in real, rather than nominal, terms.

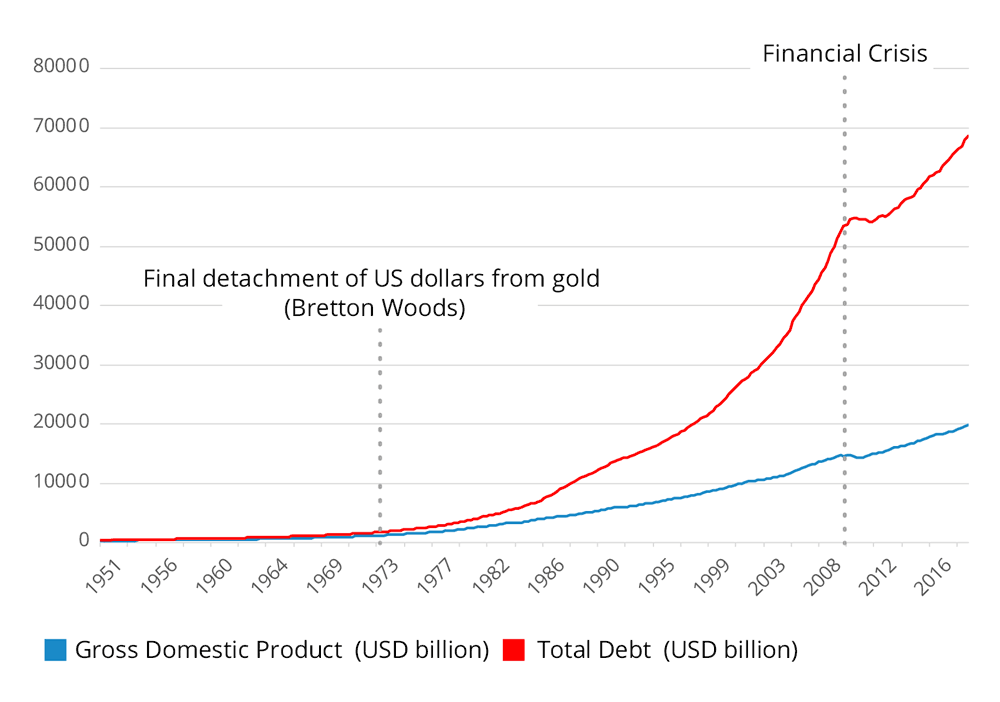

The importance of this distinction is highlighted in the chart above, which juxtaposes the US GDP growth with the nation’s total debt trajectory. Until 1972, the national debt was correlated with and analogous to the quantity of goods and services in the gross national product. Since US President Nixon closed the gold window, every country has been able to increase the money supply at will via its central bank, which has led to today’s dangerous over-indebtedness. This removal of all constraints and limitations of the State’s power over the money supply created the basis for the inflationary devaluation of assets and savings and for currency reforms, or more accurately put, for fiscal repression. It is important to protect ourselves against this; in the words of William Tell: “The wise man plans ahead”.

The same work by Friedrich Schiller, also includes another profound maxim: “You shall know them by their deeds”. RealUnit Schweiz AG adheres to this principle, which is why around 50% of assets, such as gold, silver and CHF banknotes are stored physically in Switzerland, outside the banking system, in highly secure storage facilities. In 2017, we also converted the RealUnit fund into an investment company. This allowed every investor to automatically become a co-owner and to enjoy all the democratic shareholder rights under Swiss law. As the founder of the company, I have no special privileges. To the contrary: the more the share capital grows, the less influence I have with my current stake of around CHF 8 million.

The RealUnit therefore offers greater long-term security than other collective investment vehicles such as funds – especially in times of crisis. In addition, our listing on the BX Swiss stock exchange ensures increased liquidity in line with higher volume. Finally, a vote will be held at the Annual General Meeting on April 11, 2024, on the introduction of a capital band instead of fixed share capital. This would make it possible to counteract strong price fluctuations more flexibly by means of a capital reduction or capital increase and it will help RealUnit investors to buy or sell RealUnit shares close to the intrinsic value (NAV).

There is no doubt that a strong sense of responsibility on the part of the currency issuers is crucial in order for any monetary system to function. Money is widely perceived as the lubricant of the economy. Any attempt to conceal or to artificially compensate for every dip in the economy through increased money printing is doomed to fail in the long run. This kind of interventionism is one of the main causes of overexploitation of the environment, which leaves behind a plundered, ravaged, overheated and eventually inhospitable, barren planet for future generations. This danger can only be averted through self-determination and personal responsibility on the part of individual currency users, as the great economist F.A. von Hayek explained in his book “The Denationalisation of Money” (“Entnationalisierung des Geldes”). The digitalization of the economy, in particular blockchain technology, which has proven to be reliable since 2009, not only paves the road to a new and better system, but it also ensures it will be more efficient and reliable than the current one.

After all, not even the Swiss central bank (SNB) was able to avoid sharp money supply increases since the last major financial crisis in 2008 that created enormous and unsustainable debt burdens for many countries. The SNB had to increase its balance sheet tenfold (even more than the Fed or the ECB) in order to support the Swiss economy and to protect Switzerland’s status as a business hub during this tumultuous time.

Through its sound, proven and reliable investment strategy, RealUnit Schweiz AG aims to deliver stability and resilience for all investors, but especially for those invested in nominal rather than real value assets. The long-term RealUnit performance comparison shows that we have been consistently successful in this mission since 2001, despite three major stock market slumps.

Circling back to the question of whether or not “asset protection” is a core element or a primary aim for the RealUnit: after careful consideration, we decided to stick to the original objectives of value preservation and crisis resistance.

This is because the notion of “asset protection” is misguidedly associated by most people with the nominal value of their assets, and understood in fiat money terms. What we offer to RealUnit investors is real value preservation, not an illusion of security or a hollow promise of stability within the fiat money system, which is subject to the whims of state power and which is compromised by enormous national debt burdens.

I am therefore convinced that the tried-and-tested RealUnit strategy is an excellent way of preserving the real value of one’s savings over time and protecting them from crises.