By Dani Stüssi, CEO of RealUnit Schweiz AG

Can you imagine not having access to your bank account from one day to the next and having all your cards blocked? You could be rendered instantly insolvent. “That’s unthinkable!” Not really, as two concrete examples show. But there are sensible solutions for non-bank stores of value. In this article, you will learn what requirements are necessary for this.

Example 1: Canada has 200 bank accounts frozen

In response to the Freedom Convoy protests, the Canadian government used the powers of the Emergency Powers Act in the fall of 2021 to freeze over 200 bank accounts of protesters and donors associated with Freedom Convoy. Since when is donating against the law? This massive encroachment on property rights in a liberal, democratic country like Canada was a red flag.

Example 2: Cyprus robs its citizens overnight

“We have taken immediate measures so that no electronic transfers can be made until the banks reopen on Tuesday,” Michalis Sarris, then finance minister of Cyprus, said in spring 2013. Overnight, the government decided on a debt “haircut” to address the threat of national bankruptcy and froze all accounts. Anyone who had more than EUR 100,000 in account balances was fleeced by the state and had to give up around 10 percent! However, 6.75 percent was also deducted from domestic bank customers below this threshold. A bank deposit is a loan you make to the bank. If it faces bankruptcy, drastic measures can be taken to protect the bank.

Is account freezing also possible in Switzerland?

What does it take in Switzerland for the authorities to freeze an account? I have broached this issue with several lawyers. The public prosecutor’s office can have an account frozen if there is a suspicion of a crime. The process is even faster if money laundering is suspected. Banks must monitor all payments and report suspected cases to the Money Laundering Reporting Office Switzerland (MROS) on an ongoing basis. If the latter finds the bank’s justification plausible, it can order an immediate freeze. Years ago, I personally saw how these processes can go awry. A great example was the case of a perfectly law-abiding bank client who was making a transfer for a group trip to Cuba to a fellow club member. Because the “purpose of payment” field for his transfer was filled in with “Cuba”, his account was immediately frozen as a precaution. It took several days for the account to be unblocked, but in other cases it even took months.

Regain your financial sovereignty

For years, the state has been gaining more and more control over the civil liberties of the population. As a liberal-minded person, you should be able to act independently and exercise personal responsibility – especially when it comes to your own finances. One does not want to be dependent on a central bank which is responsible for the ongoing devaluation of fiat money through the expansive money supply policy of recent years. For me, being able to access my money at any time without being dependent on a bank is a basic requirement for freedom and financial sovereignty.

Requirements for a reliable store of value outside the banking system

We live in a time of acute uncertainty and volatility on multiple fronts. Many alternative ideas to the current monetary system are being developed. Blockchain technology makes it possible to make payments independently of banks for the first time in history; worldwide and around the clock. But are cryptocurrencies suitable as a store of value, and what are the prerequisites for this? The following five criteria are crucial in order to be able to establish a real alternative in the market with a focus on value retention:

- Direct access without government interference

- High security

- Value retention and crisis resistance

- Legal and fully regulated

- Bank-independent, international transferability

The RealUnit in the form of the share token meets all five requirements, as outlined below.

Image montage RealUnit-Coin: fotofabrika – stock.adobe.com

1. Direct access without state interference

Each RealUnit share token (REALU) owner can access their tokens 24/7 without a bank. “Being your own bank” comes freedoms, but also responsibilities. To be able to store the RealUnit stock token yourself, you need an Ethereum wallet. Your assets are secured with a “private key”. The security backup for this consists of 12 randomly generated words that, when put together in the correct order, let you reconstruct your “private key”. The secure storage of keys and backups is your responsibility, but it offers the advantage that no institution can access your wallet as an extended arm of the state.

2. security

Our stock tokens are based on the decentralized Ethereum blockchain. Currently (September 2022), there are about 17,000 nodes on five continents, which means that there are 17,000 copies of the “accounting” of all previous transactions of this network. Manipulation of individual servers would be insignificant. Experts therefore agree that Ethereum is a very secure blockchain. The biggest security risk, as is often the case in IT, is the end user. There are many scams that criminals use to get your “private key”. It is important that you never save or even send this on a device with an internet connection (whether laptop or smartphone). However, unlike cryptocurrencies, as the central issuer of our stock tokens, we could start a recovery process if your key is lost. After successful completion, we will try to reimburse you for the number of lost RealUnit tokens and transfer them to a new wallet. Holders of our stock token thus benefit from one of the most secure networks in the world with an additional contingency option.

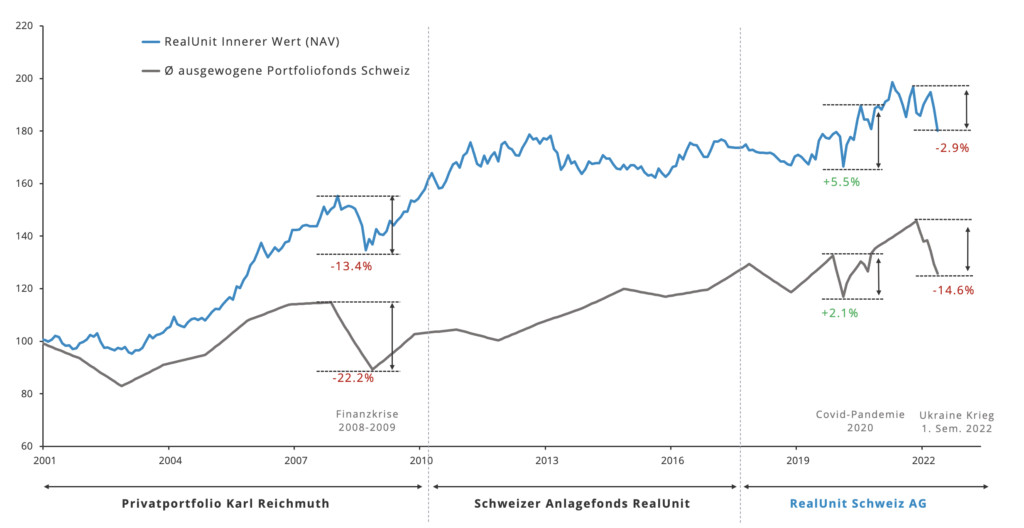

3. value preservation and crisis resistance

Wealth preservation over generations is based on a long-term strategy. Our proven real value strategy already is the result of over 20 years of experience and has as its most important goals the preservation of the purchasing power of the assets and protection against crises. Unlike Bitcoin and other cryptocurrencies, the RealUnit is backed by real assets. The performance is thus much more stable and dependent on the true valuation of the invested assets.

Sources: RealUnit Schweiz AG. The RealUnit investment strategy has been implemented in various forms since 2001. 2001-2009: Private portfolio of Karl Reichmuth, 2010-2017: Swiss investment funds, 2017-2022: RealUnit Schweiz AG. The average of the five largest “Balanced” mutual funds of Swiss banks serves as a comparison. The performance of the RealUnit before 2017 is based on a backtesting.

4. legal and fully regulated

Only fully regulated products have a firm foundation for the future. Many cryptocurrencies and digital trading platforms are still unregulated. The issuer of the RealUnit is RealUnit Schweiz AG, an investment company founded in 2017 and based in Baar. We have been listed on the BX Swiss AG stock exchange since November 2021. Our financial statements are audited by the independent auditing firm Balmer Etienne AG in Lucerne. The law firm Kellerhals Carrard in Berne conducts a so-called “due diligence” every year and thus confirms our seriousness in the stock exchange prospectus. The Swiss Association of Investment Companies (SVIG) also reviews our compliance with money laundering regulations on an annual basis. RealUnit Schweiz AG complies with all Swiss laws and is fully regulated.

5. bank-independent, international transferability

The blockchain facilitates transfers from wallet to wallet around the world within seconds. The RealUnit can thus also be used as a means of payment in a possible financial crisis, provided the recipient accepts it. Our shareholders have the option of sending their RealUnit share tokens directly to friends at the touch of a button. The recipient may exercise his or her shareholder rights as soon as they identifiy themselves to us in accordance with our registration agreement.

Conclusion

History shows that states have repeatedly ordered the freezing or even expropriation of bank assets in crisis situations. Investing in real assets on the blockchain, to which only you have direct access, is a great step towards regaining financial sovereignty. The RealUnit share token offers an interesting alternative to people who want to protect their assets from crises and a loss of purchasing power in the long term.

More information

At realunit.ch/token you will find additional information about our share token and how it differs from Bitcoin.

Image source: alinabuphoto – Envato Elements