Share price rises in Q1 2022

The RealUnit’s investment strategy delivers what it promises. The Russian invasion of Ukraine shocked the world and triggered a short-term drop in capital markets. It’s good to know that at least investments in RealUnit shares have increased in value, because it was designed precisely for such scenarios.

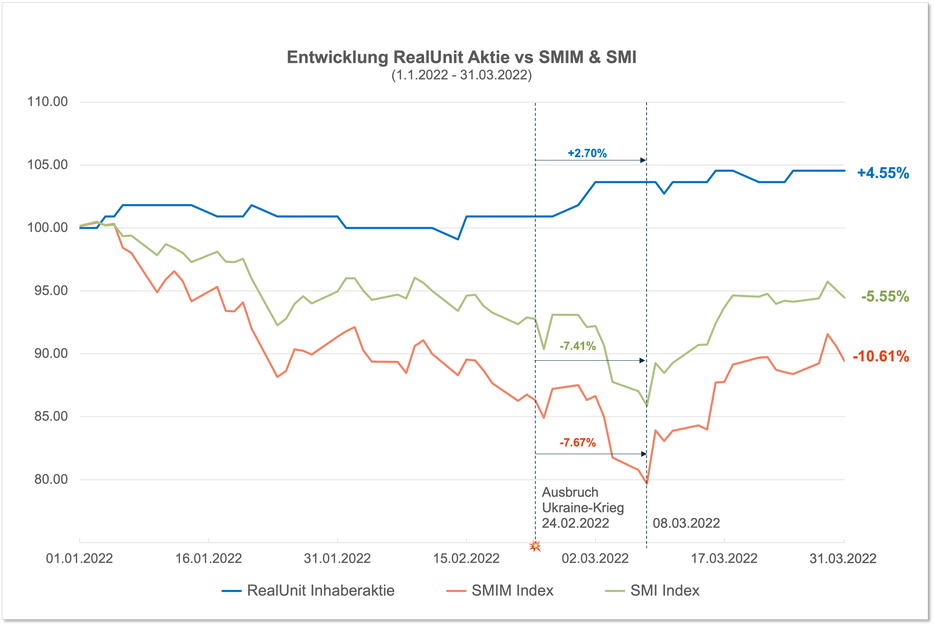

The tragic situation in Ukraine caused major stock market turbulence. Despite its renowned stability, the Swiss stock market (SMI) lost more than 7% in just a few days, while the Euro Stoxx 50 dropped more than 11%. In comparison, the value of RealUnit shares increased by 2.7%. This is very welcome news for our investors and underlines the increased crisis resistance and stability of the portfolio.

However, the outbreak of the war is not the only reason why markets have corrected significantly since the beginning of the year. Rising inflation has already been noticeable for several months (currently +2.4%) and is now being accentuated by the massive increase in energy and commodity prices. Those who simply leave their money in their bank account will clearly feel the impact over the years. Use our Online inflation calculator and see for yourself how much you stand to lose through inflation.

The investment strategy that delivers what it promises

With the RealUnit, we pursue two goals: preserving purchasing power and protecting assets even in crises. The investment philosophy behind this has been tried and tested over many years and is based on decades of experience. The RealUnit’s investment strategy already successfully demonstrated its resilience during the 2008 financial crisis and the 2020 corona pandemic.

Source: RealUnit Schweiz AG

The performance in the first three months of 2022 shows that the strategy is delivering the desired results even in the current crisis. Thanks to the large proportion of physically stored precious metals and the partial hedging of equity investments, the loss in value of stock positions was more than compensated for. Consequently, the RealUnit share price rose by 4.55% in the first quarter, while the SMI suffered substantial losses of 5.55% and the SMIM of 10.61%.

Investing in real assets pays off

While the current conflict will hopefully soon be over, inflation is bound to remain a serious concern for much longer. Thus, anyone who wants to protect their savings over the long term and maintain purchasing power should definitely consider investing in real assets.

This is because the long-term performance clearly shows that the focus on real assets offers significantly better value preservation in times of crisis and during severe market downturns than comparable investment products. At www.realunit.ch/anlegen you will find additional arguments why investing in real assets can protect your assets in crisis situations and in the event of persistent inflation.

Dani Stüssi

CEO RealUnit Switzerland AG