Those who own physical gold always have money and are always liquid. Gold, unlike fiat money, has more than maintained its purchasing power over the past few decades. The best-known precious metal has historically offered the best protection against inflation and crises. This is precisely why the RealUnit is backed by around 25% physical gold, which is stored safely in the Gotthard Massif, outside the banking system.

Gold, in addition to its use in jewelry production, has a much more important function, which is once again in great demand in today’s world. It has been an accepted medium of exchange for centuries and it is trusted worldwide as a safe haven in times of crisis. This trust is seemingly in our DNA, as gold has been used in the form of coins as a means of exchange and payment since time immemorial.

A scarce resource – soon to be depleted

If all the gold that already exists in the world were melted together, experts estimate that this would represent a cube with an edge length of a mere 22 meters. How much more gold is left? The remaining unmined gold deposits on earth are currently estimated at about 53,000 tonnes. Every year, about 3,550 tonnes are mined in gold mines and 1550 tons are recovered through recycling. Thus, in about 12 years, at constant demand, the last gold reserves will be depleted! The yellow metal is therefore a very scarce commodity, especially since it cannot be produced artificially. Of the 4,700 tonnes demanded annually (as of 2021), about 47% is for jewelry, 25% for bars and coins, and about 10% is demanded by central banks.

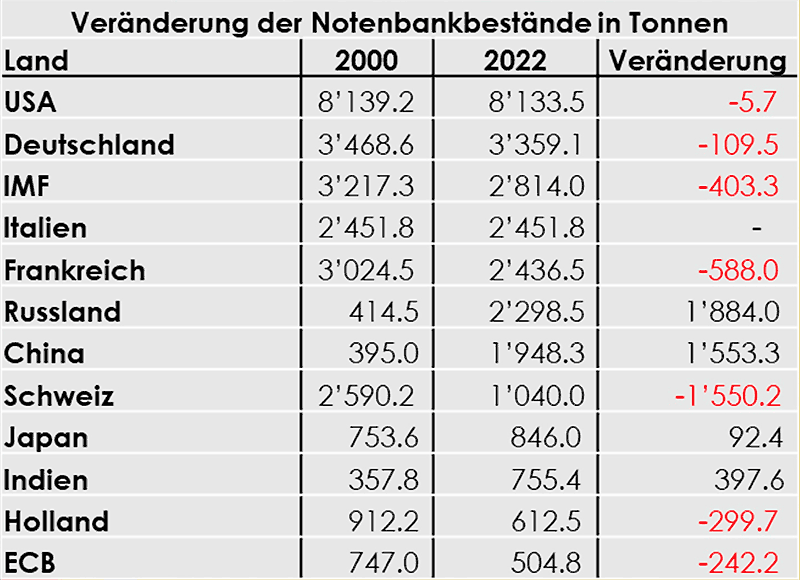

The Swiss National Bank has sold the most gold in the world in the last 20 years

For a long time, state currencies were backed by gold. On August 15, 1971, the last link between the U.S. dollar and gold was severed, completely dematerializing the global monetary system. Since then, central banks have been able to print new money without any restriction, and they have been doing exactly that, increasingly so. Gold bullion protected the long-term preservation of value.

Source: World Gold Council

Over the past 22 years, the SNB has sold over 1,550 tonnes of gold from its currency reserves, making it the biggest seller among all central banks in the world during this period. The central banks of Russia and China, on the other hand, are constantly investing and increasing their holdings of physical gold.

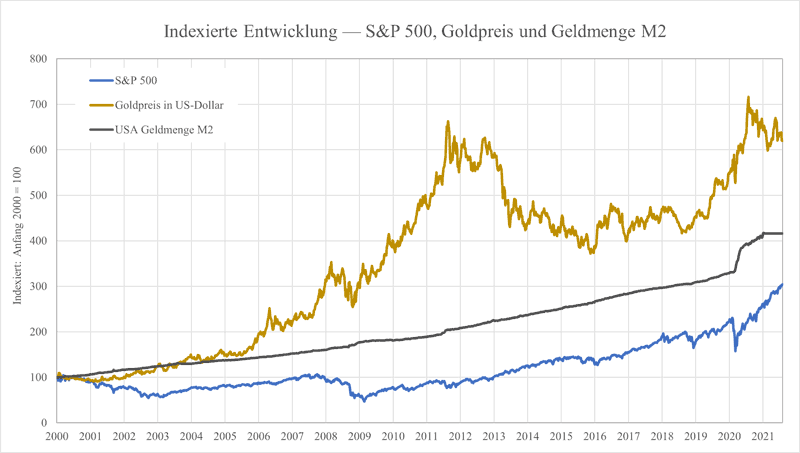

A good investor ensures good diversification in his portfolio and invests in different asset classes, which would ideally balance each other out in wild markets. The value of gold has increased with the rising money supply and has even significantly outperformed the S&P 500 stock index since 2000 (see chart).

How to invest in gold? Physically!

The price of gold is quoted worldwide in ounces and is traded around the clock. So what is the best way to invest in the precious metal as a private investor? Caution is advised when investing in gold. Gold certificates are often not or only partially backed by physical gold and the buyer bears the issuer risk. If the issuer of the certificate goes bankrupt, there is a risk of total loss. Only a few gold ETFs are backed by physical gold. And even then, the minimum delivery for most gold ETF’s known in the market is 12.5 kilograms or 400 ounces. This corresponds to the equivalent value of currently approx. CHF 736,000! It is thus recommended to buy gold in smaller physical units, such as one ounce or 5g bars, in the highest fineness and purity of 999.9 and priced close to the material value. Storage in a safe at home offers the advantage that in a crisis you can quickly retrieve and use your gold coins or bars as a medium of exchange anytime and anywhere, if you no longer have access to your bank account.

Confidence in gold as a store of value in times of crisis

The precious metal has often proven its worth in the past as a hedge against economic and political upheavals and is therefore suitable as protection against inflation and financial crises. In our investment company RealUnit Schweiz AG, we are also keenly aware and take full advantage of the benefits of gold, which is currently the largest position in our portfolio, at around 25%. Our investors are looking for long-term stability and increased resistance to crises. The RealUnit is backed by performance-oriented and tangible real assets, the majority of which are held securely outside the banking system. Since gold does not yield a return and has a low correlation to the real economy, around 40% of our portfolio is also invested in listed companies with a healthy balance sheet and a sustainable dividend policy.

-

Unternehmensbeteiligungen (40%)

- Fokus kotierte Aktien mehrheitlich aus der Schweiz

- Solide ausländische Aktien aus politisch vertretbaren Staaten

-

Physische Metalle* (35%)

- Hauptsächlich Edelmetalle

- Einzelne Positionen in physischen Industriemetallen

- Gesetzliches Zahlungsmittel CHF (physisch)* (16%)

- Nominelle Anlagen (7%)

- Krypto (2%)

*ausserhalb Bankensystem in der Schweiz gelagert

Stand: 31.03.2022

In our opinion, diversification into different real assets is crucial for savers and investors to maintain the purchasing power of their money over the long term. For us, gold plays a decisive role in this, as a proven “crisis insurance”. More information about the RealUnit.

Dani Stüssi

CEO of RealUnit Switzerland AG