By Dani Stüssi, CEO RealUnit Schweiz AG

Gold is the largest position that the RealUnit holds, accounting for around 25% of our asset allocation. In 2023, the gold price rose by approximately 7% against the USD. During the same period, the USD lost about 8.2% of its value against the CHF. Therefore, in the past year, the metal incurred losses for CHF investors. The gold price has also slightly decreased in the first 2 months of 2024. Despite this, we will still maintain our high allocation to the yellow metal, for the reasons we’ll outline in this article.

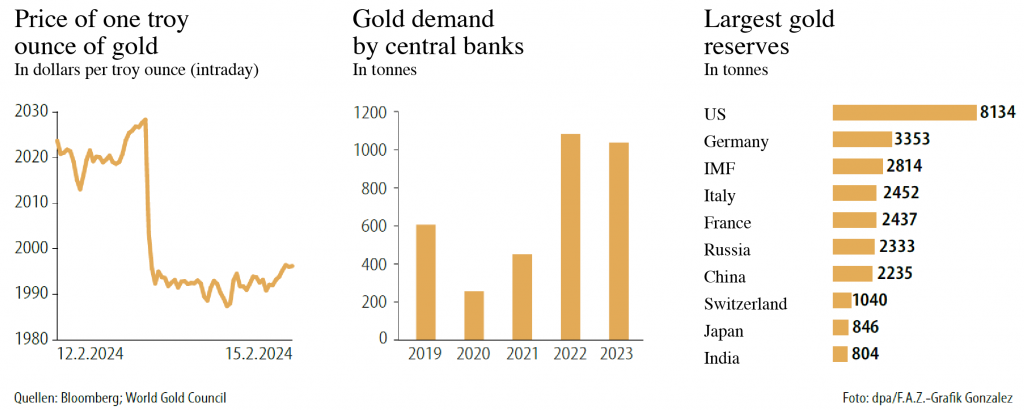

The following charts from the Frankfurter Allgemeine Zeitung (February 16, 2024) tell a very compelling story:

Central banks, through their monetary policies in recent years, have put great pressure on the gold price and played a pivotal role in pushing it to the levels it has temporarily retreated to, below USD 2000. At the same time, however, they have also been actively purchasing record amounts of the metal and at a record pace. Over 90% of gold trading occurs through derivatives and options, leaving less than 10% traded in physical gold on a daily basis. It is therefore not surprising that short-term price corrections and fluctuations, such as those we saw in mid-February 2024, can be influenced by major market players.

The reason why central banks have been increasingly building up their gold reserves since 2022 is likely related to the unprecedented measures deployed against Russia: the country’s USD reserves were frozen and used for the first time in history as a “sanction instrument”. In response to this, various central banks, primarily non-western ones in regions such as Southeast Asia and South America, converted part of their USD reserves into gold in 2022-2023, to protect themselves and to avoid sharing the same fate as Russia in the future.

Since the 2008 global financial crisis, central bankers have taken it upon themselves to fight against and to mitigate every economic downturn on behalf of politicians – it’s hardly surprising, since our current fiat money system is built upon and dependent upon a state monopoly. This has led to increasingly short-sighted measures and to the expansionary monetary policy of the last decade. The end result was of course inflation and the subsequent sharp increases in benchmark interest rates in 2023 will have a huge impact on the prices of real assets. Real assets are scarce and cannot be simply created out of thin air and at the push of a button like fiat money. We are therefore convinced that a well-diversified investment strategy with a focus on qualitatively robust companies and a high precious metals allocation will deliver long term stability and true value preservation.

However, gold doesn’t just serve as a portfolio stabilizer, it also enhances crisis resistance. Gold has proven its worth as a store of value and medium of exchange for thousands of years, especially in times of war and turmoil. The precious metal has often been used in the past as a hedge against economic and political upheaval and can therefore offer time-tested and reliable protection against inflation and crises. A look back at the last few decades alone makes it clear: most currencies have lost a tremendous part of their value due to inflation; some don’t even exist anymore. Gold, on the other hand, has remained stable and dependable for generations.

Our investors are co-owners of our physical precious metal holdings that are securely held outside the banking system in private storage facilities in Switzerland. This affords direct access to the metals, even in the event of a severe financial crisis, and minimizes counterparty risk, which sets us apart from investment solutions offered by banks.

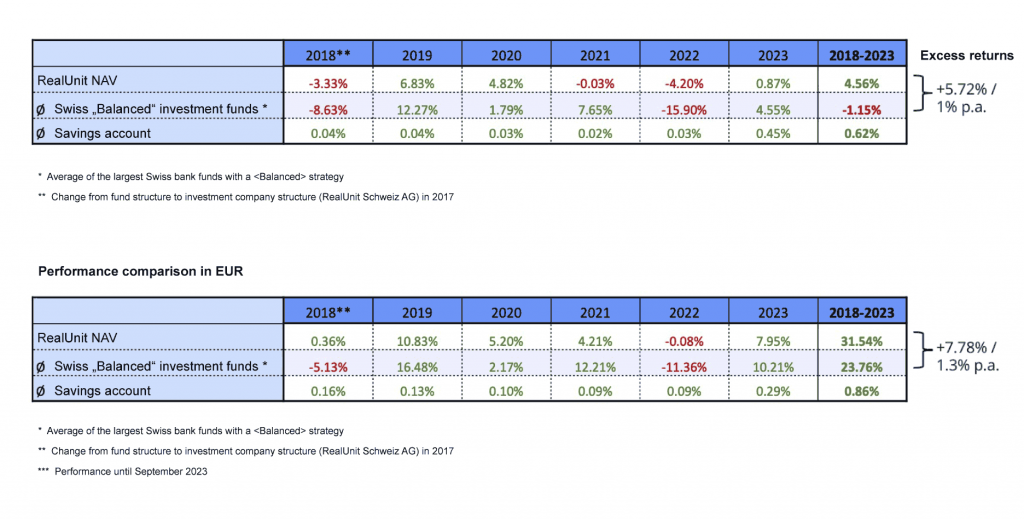

Regarding our equity holdings, although they may be subject to short-term fluctuations, they offer the most reliable long-term guarantee for investors and they enable us to fulfill the primary goal of the RealUnit: value preservation. By selecting quality stocks with attractive dividend yields and resilient business models, not only do we strive daily to protect and preserve the value of our investors’ assets, but also to deliver real, sustainable growth over time through dividends and capital gains. We have been consistently successful in this endeavor since 2018. This is clearly reflected in the table below, which compares RealUnit’s performance with the five largest Swiss investment funds with a “Balanced” strategy.

The proven strategy behind the RealUnit offers an optimizing rather than maximizing store of value for investors seeking both purchasing power preservation and crisis resistance.