Are we on the cusp of a societal shift?

A contribution by Karl Reichmuth, Chairman of the Board of Directors of RealUnit Schweiz AG

The discovery of money, and with it the efficient exchange of goods and services of all kinds, constituted an unimaginably humanitarian act of progress. Money also became the generally accepted unit of account. This made it possible to keep records of assets and liabilities in an independent fashion. The coins, originally minted from valuable metals, led people to believe that money was also a reliable means of preserving the purchasing power of their savings. This may have been the case in the past, but since the emergence of unbacked paper currencies, the store of value function of money has been lost. Despite repeated abuses of its currency issuing power, which have led to inflation of the money supply and even to state bankruptcies, the State still retains its monopoly on money to the present day.

However, public trust has sharply deteriorated in recent years and this monopoly is increasingly being called into question. The 2008 financial crisis and the 2011 euro crisis unsettled everyone. New FinTech solutions, especially blockchain technology applications, are now enabling money issuance in a decentralized manner. Private parallel currencies are already in circulation – though some of them have dubious or no backing – and state institutions are seeing clear threats to the monetary status quo. Surprising results in the Italian elections, for example, are causing the euro to waver once again, and French President Macron’s blackmailing stance against Germany is being widely discussed. The language and actions of the U.S. president as the representative of the world currency, the U.S. dollar, are also evidence that the monetary order is faltering.

In light of the impending changes at the monetary macro level, I – as a banker with over 60 years of experience – have felt compelled to redraw the “magic triangle” of investing:

Swiss economist Beat Kappeler recently recommended in his NZZ am Sonntag column that “one should think about the time after the upswing – even though guarantees and supposed stabilizers are still being developed at the moment.” In my opinion, it is this kind of “developing” that brought us zero or even negative interest rates. This experiment is historically unique and it is meant to facilitate the growth of the economy perpetually. In the short term, it may work; in the long term, however, it has been empirically proven that after strong credit surges, the financial world, and then also the real world, must sink. In order to be prepared for this period, I believe that the newly formulated investment objective of “crisis resistance” should replace “security”. Those who would still equate the term “safe” with “governmental” are bound to fail. Up until recently, it was widely accepted that the state, as a direct debtor, guarantees “security” by means of government bonds or via its extended arm, the banking system. However, almost weekly now, newspaper articles or even books appear that question this dogma. One of the most readable is probably that by Lord Mervyn King, the long-time president of the Bank of England, on the “end of alchemy” in monetary affairs. When even someone with so much “insider knowledge” starts writing critically, it’s time to take appropriate precautions.

At Europe’s oldest bank, Monte dei Paschi di Siena, the director was called “Provveditore”. His task was to look ahead, make provisions and take precautions. This top leadership role has been replaced by mere “managers” in Anglo-American banking. This led to short-term profit thinking, not least because of the transparency requirements of the big banks, which were in the public spotlight. Following the politically skewed mandate of the U.S. Federal Reserve, the entire monetary system deteriorated into a short-term oriented economic policy. In the globalized world, central banks lost their independence – even the Swiss one.

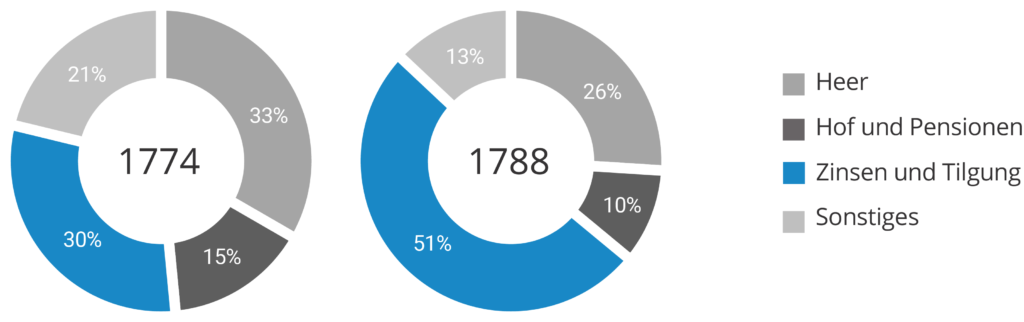

A panel of highly talented economists tried to figure out the limit of a serviceable national debt. They did not come to any concrete conclusion. The lack of results is probably due to the fact that the debt ceiling depends on various factors and a generally applicable rule thus does not exist. I found the example below in the history book “Grundstock des Wissens” from the publishing house Serges Medien. It dates back to the early days of probably the greatest social upheaval, the French Revolution. King Louis XVI and his predecessors became indebted because of war expenditures and the endless extravagance of the royal court. The high level of indebtedness for such largely unproductive expenditures meant that in 1788 half of government spending had to go to interest and repayments.

The spending habits of the “royal court” of the time bear a certain resemblance to the skyrocketing budgets for today’s “state dependents.” In many nations, more than 50% of citizens already receive support from the state in the form of “social spending”. Since the 2008 financial crisis, for example, the public debt of eurozone countries has increased from 66% to 87% of GDP, although economically strong Germany has been able to keep its direct, explicit public debt at the previous level of 63% of GDP. As is well known, Germany represents about 1/3 of the euro area; i.e., most member states now have debt ratios above 100%. One must also keep in mind that in the above historical example of the French royal court, spending was more easily calculable compared to the modern state: For today, a large part of the debt consists of long-term promises, e.g. in connection with pension entitlements, which are not even included in these debt ratios! There are certain estimates that put over-indebtedness levels over the 300% mark. Ultimately, the question of the limit of still serviceable government debt is above all also a question of interest rates.

As is well known, interest is the price of money. This price naturally results from two factors: the time preference of the individual propensity to consume and a risk premium. For how long can the European Central Bank keep justifing almost 0% rates, even in bad debtor countries? What happens when natural interest returns with full force? Even central banks cannot work miracles forever and negative interest rates are like water flowing uphill!

Ultimately, it is the socio-political implications that motivated me reformulate the magic triangle. A study by well-known economists from England confirmed that rich people rapidly become richer in times of high price increases of real assets, while savers and pensioners do not benefit from such artificial money manipulations. For reasons of supposed stability, they remain in nominal investments. In this way, they become poorer in relative terms, while the rich, who profit from money and debt boosts, become richer. This reduces the share of votes held by the so-called middle class and, in the long term, jeopardizes democracies that safeguard freedom and thus the continued existence of a prosperous, genuine market economy.

Lucerne, September 18, 2018 / KR-var

Photo by Freddie Collins on Unsplash