Differences between Bitcoin & RealUnit

- The RealUnit is backed by real assets

- The price of Bitcoin depends on supply and demand

- The price of the RealUnit depends on the value of the capital investments

You are currently viewing a placeholder content from YouTube. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationDifferences between Bitcoin & RealUnit

- The RealUnit is backed by real assets

- The price of Bitcoin depends on supply and demand

- The price of the RealUnit depends on the value of the capital investments

You are currently viewing a placeholder content from YouTube. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationRealUnit and Bitcoin share the same vision - the separation of money and the state

State authority is growing day by day, privacy rights are being eroded, the financial sovereignty of the individual is dwindling. The centralization and concentration of power is happening in slow, almost imperceptible, but steady steps. This type of threat is all too often overlooked or dismissed, although it is the most widespread and the most insidious.

And it is this type of threat that was first effectively fended off by Bitcoin thanks to its decentralized blockchain. Bitcoin cannot be shut down at will (this can only be one by shutting down the Internet itself). Bitcoin cannot be manipulated and inflated at the whim of a central banker and it cannot be banned, as is increasingly the case with cash. Bitcoin thus offers a way to store your savings independently of the banking system.

The RealUnit also uses a decentralized blockchain and can be freely transferred from wallet to wallet. Unlike Bitcoin, however, each token is 100% backed by real assets. This brings more stability and an anchor to the real economy.

Comparison of RealUnit token and Bitcoin

| Characteristics | RealUnit Token | Bitcoin (BTC) |

|---|---|---|

| Store of value | Yes | Yes |

| Backed by real assets | Yes | No |

| Tradable on the Blockchain | Yes (Ethereum-Netzwerk) | Yes (Bitcoin-Netzwerk) |

| Token supply | Flexible, depending on the premium/discount to the net asset value | Fixed at 21 million BTC (scarcity incentive) |

| Inflation protection | Yes (through investments in performance-oriented und real assets) | Yes (through «Halving» every four years) |

| Performance | Focused on value stability | High fluctuations |

| Price discovery | Intrinsic value of underlying investments | Market supply and demand |

| Governance | Every share or token has a voting right (shareholder democracy) | Decentralized structures with core developers, node operators and miners |

How to choose: Bitcoin or RealUnit?

In contrast to the RealUnit, Bitcoin has no real asset backing. The value of a Bitcoin is very controversial among experts. Bitcoin’s market price is strongly dependent on supply and demand. If demand is very high, the price rises sharply. However, if demand decreases massively in the future, the price will also fall accordingly.

The RealUnit, on the other hand, is largely backed by real assets. It is to be expected that the value of the RealUnit will be much more stable than that of Bitcoin. The target groups for the two concepts can therefore be differentiated as follows based on a classic investor profile: The RealUnit is the right choice for savers and conservative investors, while Bitcoin is more for risk-taking investors.

Tokens backed by real assets and cryptocurrencies

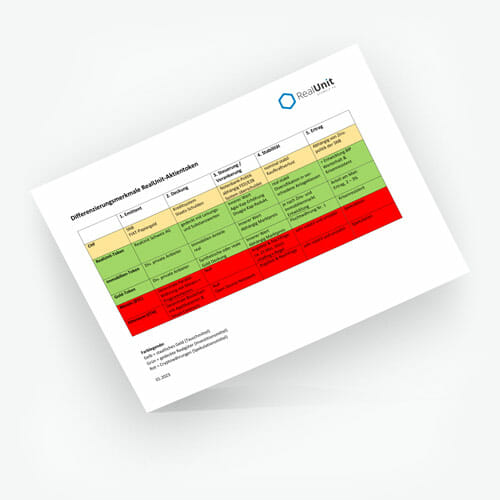

Distinguishing features of the RealUnit share tokens

Download the table as a PDF: